Why is it free?

Every child deserves to grow up with the right tools, and that includes understanding money. We are offering free access to this guide because we believe financial wisdom should start early, without barriers. Inside, you will find stories, activities, and confidence-building steps that gently introduce kids to money in a simple and engaging way.

Just cover a small processing fee to unlock your guide instantly and begin this powerful journey with your child. It is more than a workbook, it is a way to raise kids who feel empowered, prepared, and proud of the smart choices they make.

Whats inside guide?

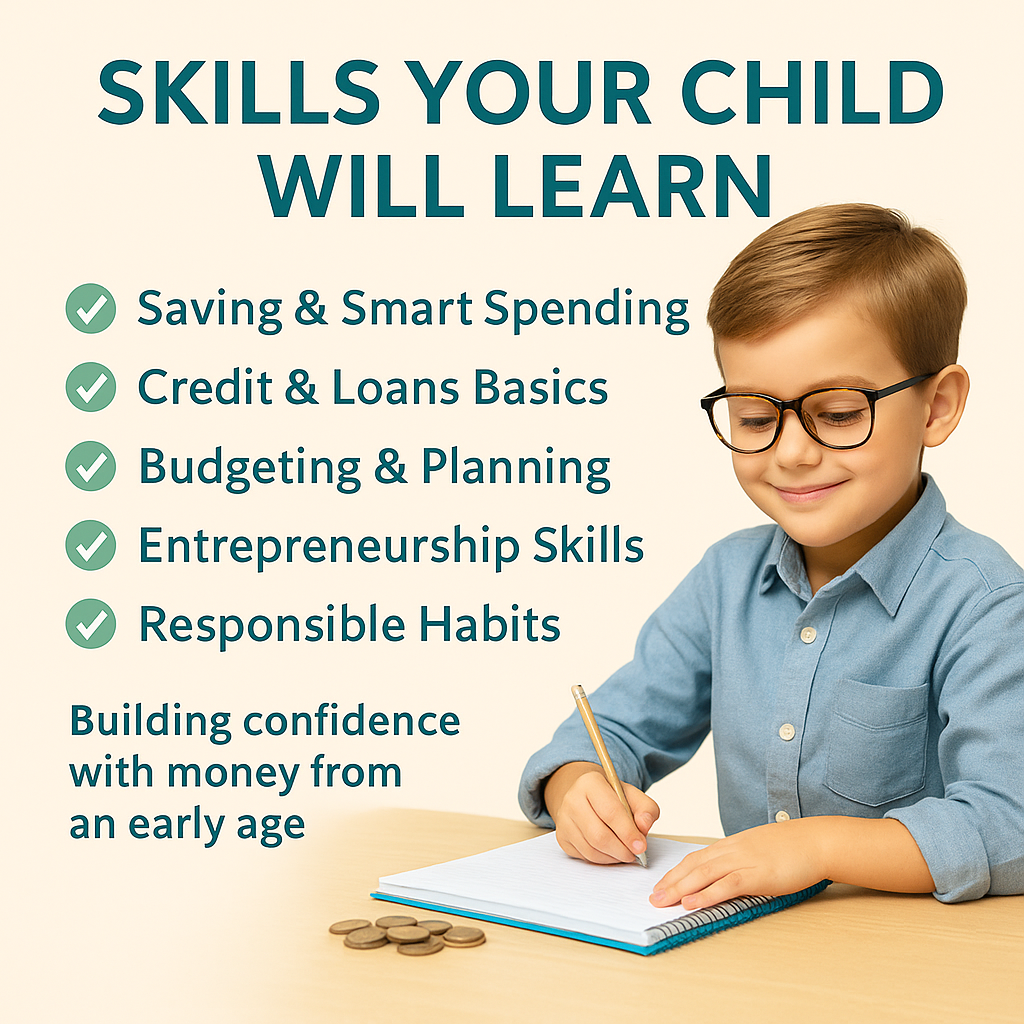

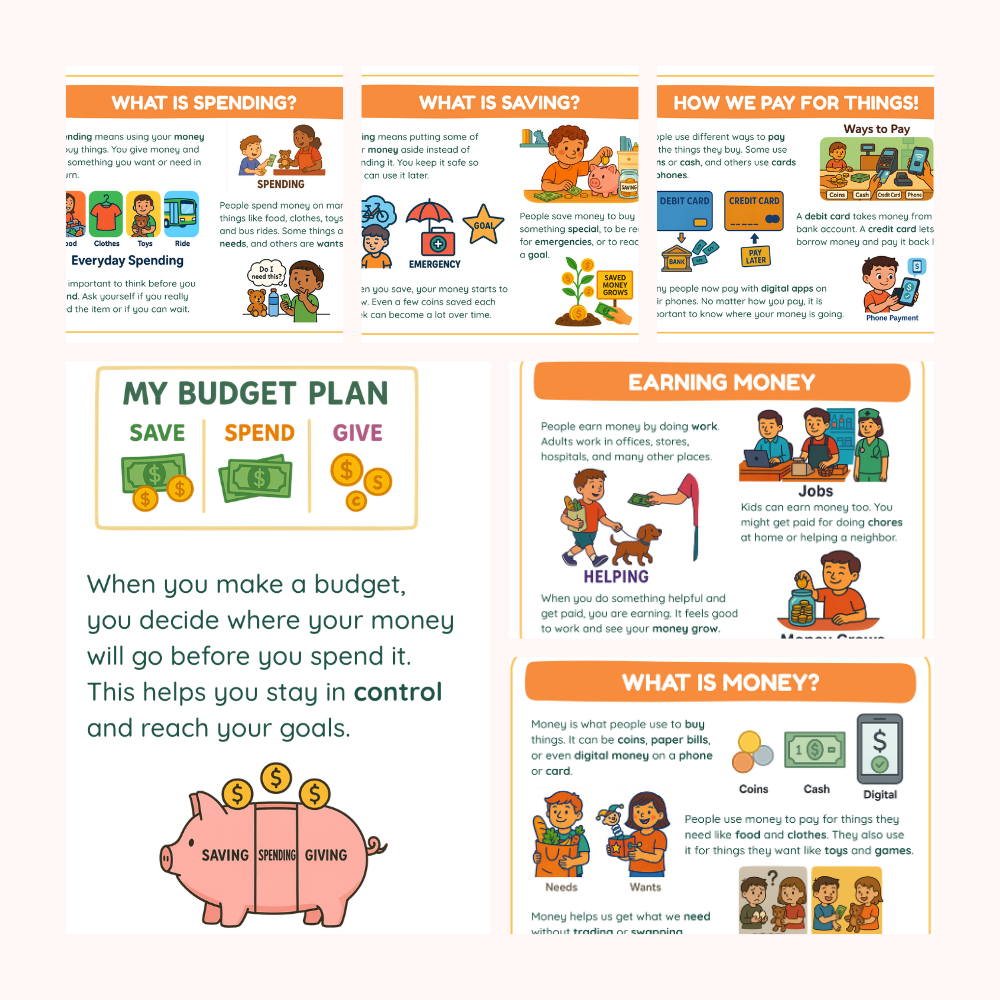

🧠 Children begin by understanding what money is and why it matters in the real world.

🧐🏧From there, they explore how we earn, spend, and save — with age-appropriate explanations that make learning feel natural and fun.

🪜 The guide walks through the basics of budgeting, the difference between needs and wants, and how to plan for short and long-term goals.

🏦 Kids also learn about types of bank accounts, how credit cards work, the concept of interest, and why taxes exist.

🎦 Every topic is paired with simple, visual activities that help turn knowledge into real habits.

📖 With over 60 pages of printable content, this guide is designed to make financial literacy easy to grasp and enjoyable to explore.

Why Choose Money Growth Guide?

👩🏫 🧒We believe that teaching kids about money shouldn’t be complicated or boring. It should be clear, engaging, and meaningful.

👨👩👧👧 Our guide was created by real parents and educators who saw a gap in early financial education.

🎯 We wanted something simple enough for kids to understand, but powerful enough to make a lasting impact.

🏸 Money Manners for Kids is designed to build real-world skills through activities that spark curiosity, build confidence, and encourage better decision-making from an early age.

🥱We’re not here to lecture. We’re here to help parents raise money-smart kids who feel capable and prepared for the world ahead.

What Makes Us Unique

💵We don’t just teach kids how to count money. We help them understand what money means and how to make thoughtful choices with it.

🏎️ Most resources focus only on facts or quick lessons. This guide focuses on building real awareness around saving, spending, and setting goals in ways kids can relate to.

🤩 Lessons are short, visual, and hands-on. They’re designed to match the way children learn best, so they stay curious and engaged.

🪜We believe financial skills should start early and feel natural, not overwhelming. That’s what makes this guide different and truly effective.

💸Show Your Child How Money Works

🏦Build Financial Confidence with Clear, Supportive Learning

Why is Learning About Money Important?

💸🏦 Learning about money isn’t just about dollars and cents. It’s about helping kids understand how the world works, make smart decisions, and feel confident with real-life responsibilities.

👦👧 When children learn the basics of saving, spending, and planning early, they grow up with less stress and more independence.

💯🥇 It’s not about being perfect — it’s about building habits that last a lifetime. Teaching kids about money today sets them up for a future where they feel capable, calm, and in control.

🔍💡 Kids start understanding that every choice has consequences, helping them make smarter decisions.

🛒🧠 This simple but powerful habit helps reduce impulse buying and builds long-term money sense.

🤲📈 Things like allowances and small purchases give kids confidence and teach responsibility.

Testimonials

💚 Builds Knowledge, Confidence & Money Sense

See why parents and teachers trust the Money Growth Guide a thoughtfully designed resource to help kids understand money clearly and confidently from a young age.

95%

Said their kids understood saving and spending better after using the guide.

92%

Said it made learning about money fun and stress-free.

94%

Said their child now asks smart questions about everyday purchases.

90%

Said it helped spark meaningful family conversations about money.

Why Families Trust Money Growth?

|

Others | |

|---|---|---|

Builds Financial Confidence |

||

Teaches Smart Choices |

||

Encourages Real-Life Thinking |

||

Easy to Understand & Fun |

||

Parent & Teacher Approved |